Lawrence, KANSAS – According to the state officials, HB 2239 increases the residential property tax exemption, prorates some personal property taxes, provides homestead property tax refunds to eligible taxpayers, and broadens the property tax reduction authority of county commissioners for property destroyed by disaster.

State officials said that HB 2239 also provides tax credits for graduates of aerospace and aviation-related educational programs and employers of program graduates, school and classroom supplies purchased by teachers, contributions to community colleges and technical colleges, and qualified railroad track maintenance expenditures of short line railroads.

The bill provides additional personal income tax exemptions for disabled veterans.

The bill also creates a sales tax exemption for the purchase of necessary supplies to reconstruct or repair fencing for agricultural land damaged or destroyed by natural disaster, providing important tax relief to farmers and ranchers impacted by recent wildfires.

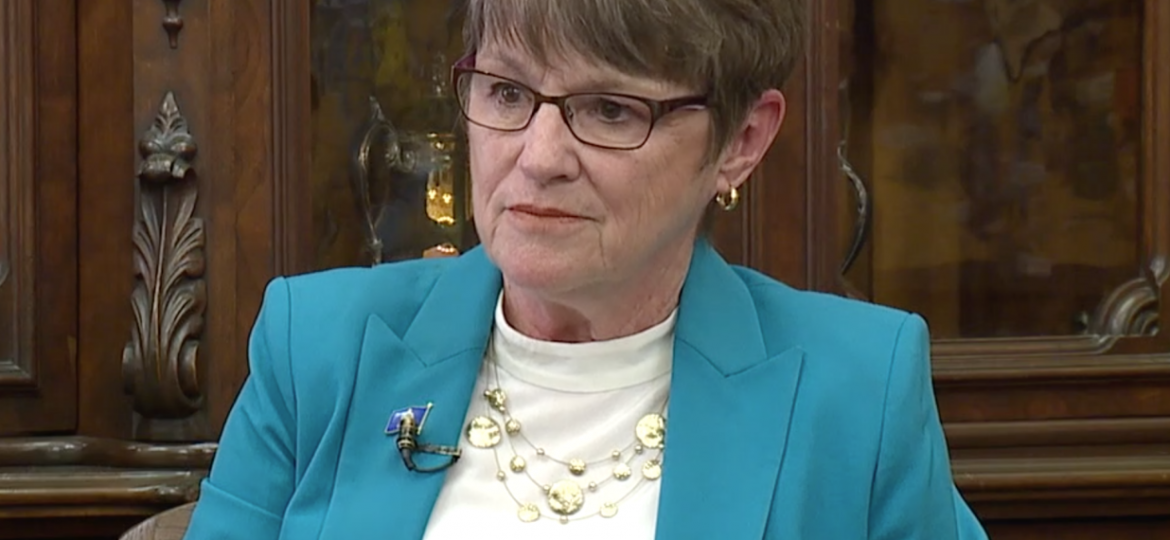

Governor Laura Kelly released the following statement:

“Our fiscal responsibility has put Kansas back on track. We’ve been able to fully fund our schools, fix our roads and bridges, balance the budget, and cut property taxes, providing relief for Kansans.

We have the opportunity to help Kansans who are feeling the impact of pandemic-induced inflation. With the largest budget surplus in decades, we can do both – provide property tax relief and finally eliminate the state sales tax on food.”